UCLA Corporate Financial Services

Personnel is pleased to announce ADP iPay Statements, a new benefit for all partners. Through ADP, our payroll supplier, we are able to provide you access to your profits statements and W-2 forms 1 Day each day, 7 days a week. In addition, you can make changes to your W-4. Simply key in your modifications, print the form, sign it and forward the completed kind to your Payroll Department for processing.

Your universal security employee pay stub is available for seeing on the web. The Worker PAY STUB service allows you to keep wage and associated records methodically submitted, easily available and protected online. Signing up online only takes a couple of minutes so you can see your paystub. The first step in discovering ways to see your paystub online is by clicking on the leading PDF link below to view a PDF document.

This page provides a reference to the info consisted of on the paycheck stub. Individual paycheck stubs will differ depending upon the kind of pay and reductions individual staff members receive. You must examine the info on your income stub, specifically when modifications have been made to your records.

Because each stub is connected to a University income, it is not possible at this time to print additional pages in cases when info will certainly not fit on a single stub page. Duplicate copies of Universal Security Paycheck Stub info may be asked for by calling Payroll Services or by completing a Record Demand Type.

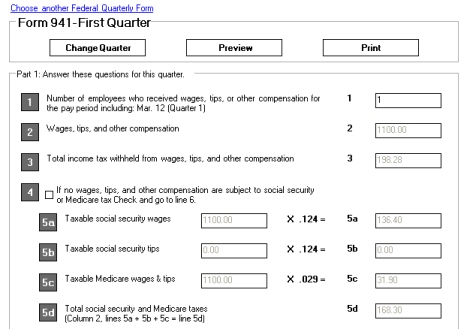

The body of the stub shows employee and pay information. All profits and deductions details may not appear on income stubs due to space constraints. The following info is discovered in the first area of the paycheck stub; most of it (except for the check date) comes from the Worker Database (EDB) and is based on information that you offer to the department.

The gross revenues are lowered by particular deductions which reduce the taxable revenues for federal and state earnings taxes and for that reason decrease the quantity of federal and state earnings taxes kept. These decreases are listed separately in the Tax Sheltered column of the check stub under Deductions, listed below.

Pay Type – A list of each type of pay consisted of in this payday, such as Regular, Overtime Straight, Overtime Premium, or Shift Differential. See Related Details on the right to discover more details about the various pay type codes.

The leave accrual section contains leave info for sick, getaway and compensatory time that was offered at the time the income stub was printed. The start balance, quantity accrued, amount taken, and final balance are shown for each leave type, if appropriate.